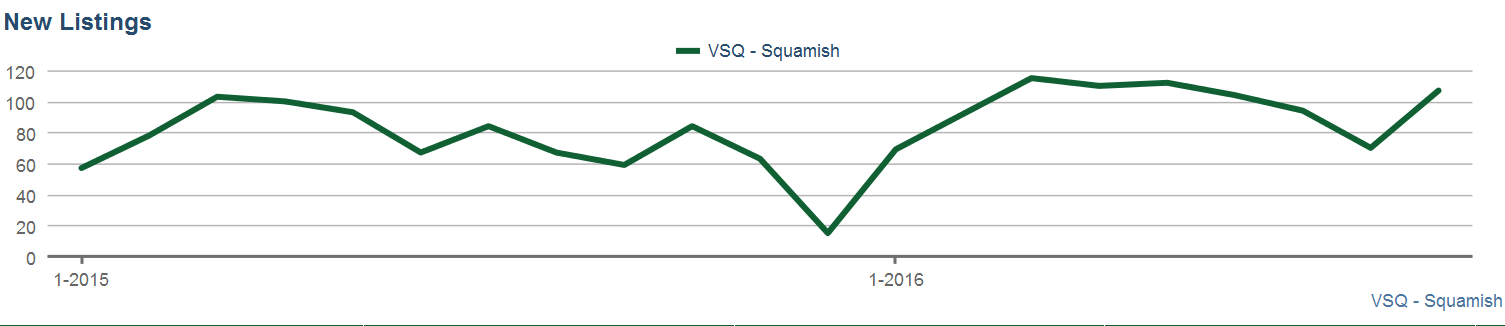

The spring selling season is about to begin! Many sellers are wondering if 2018 will present the same strong selling conditions that we have seen in recent years. Our answer is a resounding YES! The buyer activity in Squamish is only being tempered by the lack of listings on the market. Squamish is booming and homes like yours are in top demand! Here are 7 Squamish Real Estate Stats that will make you want to sell this spring and why we are your Squamish real estate team of choice.

GET A FREE MARKET EVALUATION OF YOUR SQUAMISH HOME

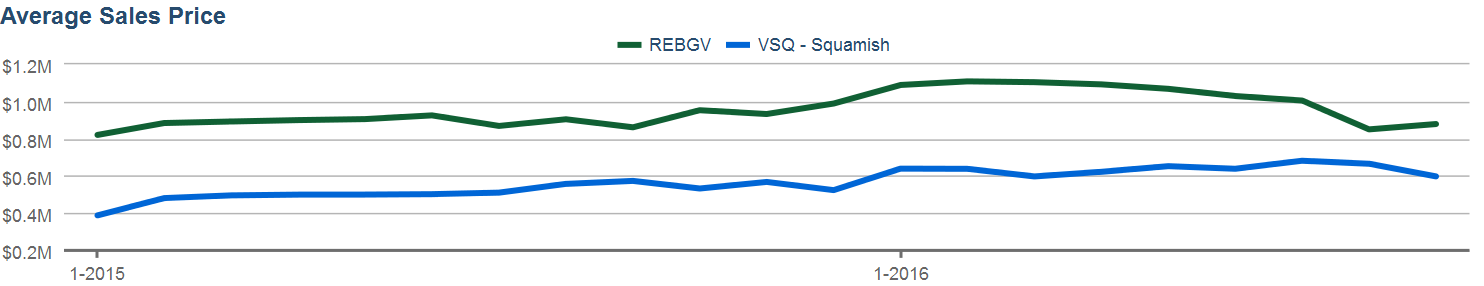

1. Since the beginning of 2015 the average detached home price has gone up 82 percent, the average townhome has risen 99 percent and the average condo price has increased 76 percent

This is a whole lot of additional equity in your home if you owned before 2015, and even if you bought afterwards, prices have continued this upwards trajectory even in the last 12 months. For the average single-family home this means an increase of $457,207, $419,500 for townhome owners, and $201,400 for condo owners.

2. Homes attract stronger sales prices during the spring selling season

Spring is the selling season. If you’re looking to get maximum price for your home, then it’s best to sell it between March and June. The percentage of original price is a ratio used to determine the percentage of the original list price which a home sells for. Looking at historic data for Squamish, this ratio is right around 100 percent between the March and June period for the last three years. Meaning most homes sold right around asking price.

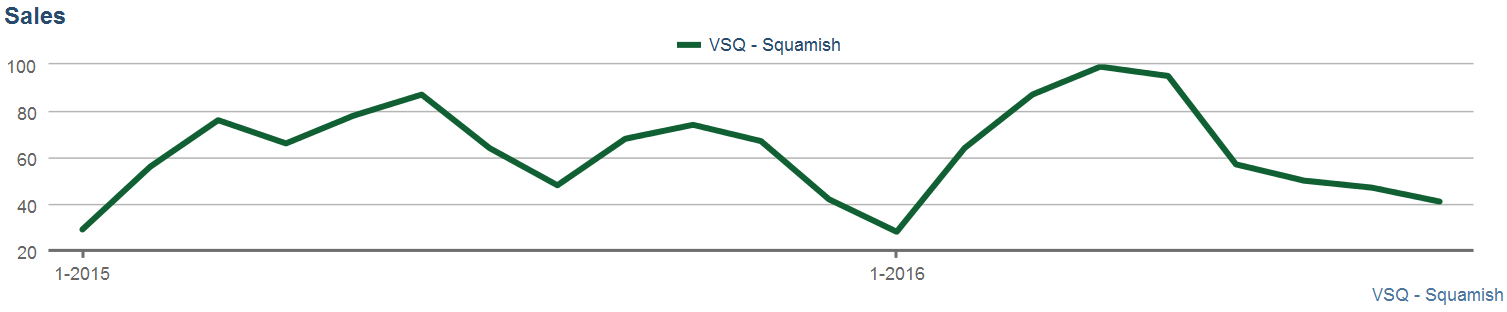

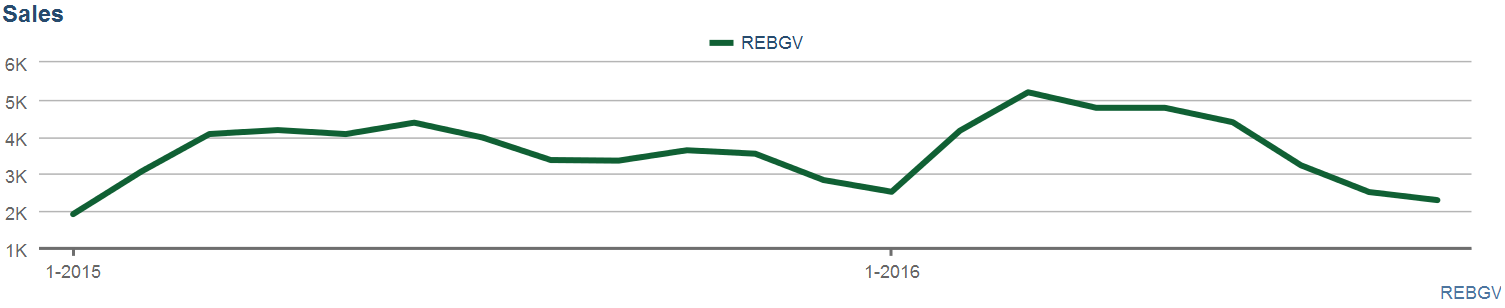

3. There are nearly 50 percent more sales in spring

In Spring 2017 there were 316 home sales in Squamish between March and June, the four-month period between September and December saw about half of that. One obvious reason is more people list their homes in spring, but buyers know that spring is the time to buy and this is when the majority of the activity happens in the market.

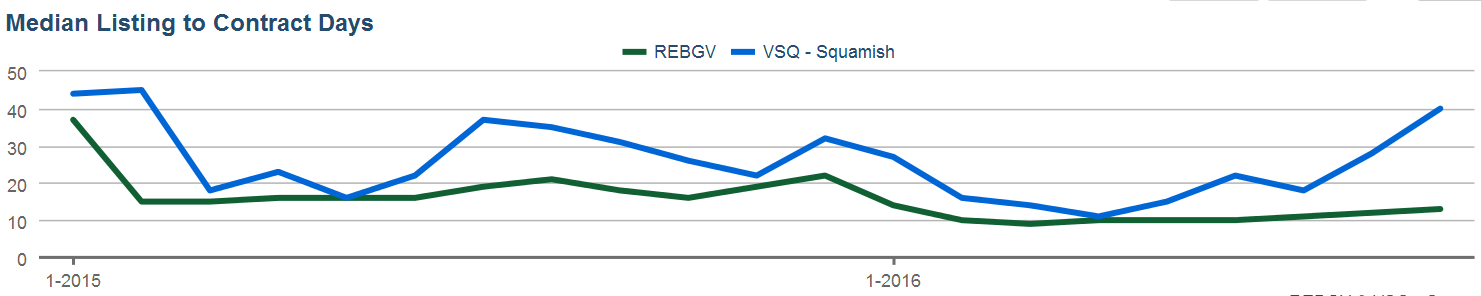

4. The average days on market in spring is less

If you’re looking to sell your home quickly and for the most amount of money, spring is the season to sell. Last year the average days on market (DOM) during spring was 24. That’s less than a month of having your home for sale before a deal completes. Fast forward to winter and you’re looking at 30+ days on average to sell. The longer a home stays on the market, the less it appeals to buyers and the more likely a price drop or a low offer will come in

5. Interest Rates are on the rise

Although interest rates are still historically very low, they are on the increase, and this could impact property prices in the medium to long term. Only yesterday (January 17th) the Bank of Canada raised rates by another .25 percent. With the Bank of Canada projecting continued inflation and rate rises over the next few years, the impact on buyers and property prices is unknown. What is known is currently there is tremendous demand for Squamish property and prices haven’t taken a hit by the recent rate changes yet.

6. Buyer’s are most active in Spring

Property sales are one metric that proves this but when we look at page view data from our buyer’s website www.movetosquamish.ca it’s clear that there is peak traffic of interested buyers during the spring selling season.

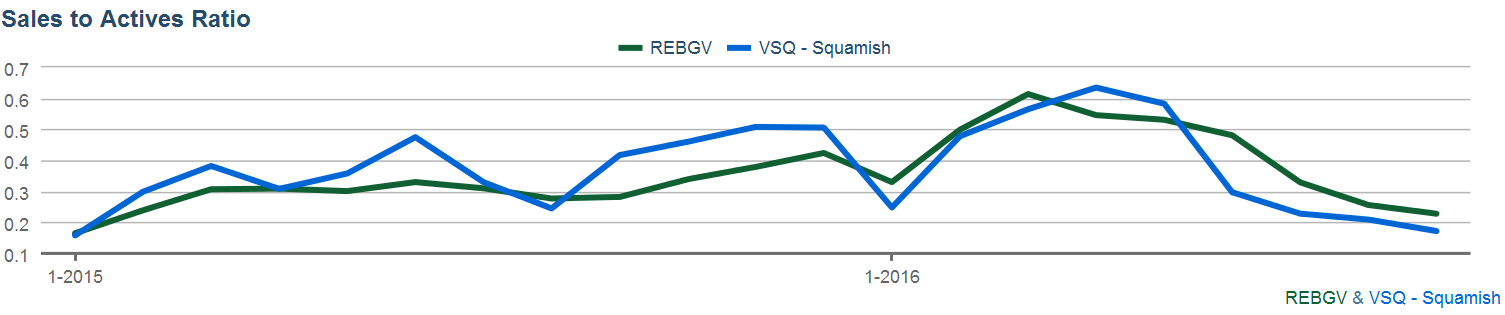

7. It’s a solid seller’s market in Spring

The sales/active ratio or market absorption rate is one indicator of the type of real estate market present. According to this ratio anything above 20 percent is a seller’s market, anything below 12 percent is a buyer’s market and anything in between the two is considered a balanced market. For the last three years this ratio has been greater than .30 percent during the spring selling season (it went up to .47 last May) meaning the market is substantially in favour of sellers this time of the year.

These stats support the fact that spring really is the time to sell in Squamish, and after three stellar spring seasons in a row, some sellers are wondering if 2018 will bring the same favourable conditions. If you’ve been wondering if you should sell this Spring, here are 7 reasons why it is time to do so. Favourable selling conditions like this won’t last forever but they are here right now, if selling is something you’re considering then please reach out, it’s time to pre-jump the spring market and begin the process of selling your home!

How do I begin the process of selling?

- First, we will do a free market evaluation of your home to give you a ballpark range of what your home may be worth in the current market

- We will then (if we haven’t yet) meet you first-hand and discuss your unique position, goals and objectives when selling, and to make sure we are a good fit for your needs

- Next, we will develop a custom marketing strategy for your property. This will consider your unique position, goals and objectives, market conditions and unique features of your home.

- Now it’s time to get your listing live. We will create marketing materials to promote your property, and leverage our extensive marketing and technology networks skills to launch your home with the biggest market impact possible.

- During the period when your home is for sale, let my 30 years of Squamish real estate experience work for you, while at the same time Meghan’s expert marketing skills will expose your home to the most buyers possible through our own website Move to Squamish, as well as multiple other on and offline channels.

FOR A FREE NO-OBLIGATION MARKET EVALUATION OF YOUR SQUAMISH HOME- CLICK HERE

To learn more about our dynamic real estate team combining top-selling local real estate experience, the most recognized real estate brand in the world RE/MAX, and cutting-edge digital marketing expertise GET A FREE MARKET EVALUATION OF YOUR HOME and let’s begin the process.

-560-wide.jpeg)